MTA returns: Is 2011 a “consolidation year”?

In February, 2010, I wrote about how the little marine electronics industry could use some market intelligence — often called MI — and welcomed a startup firm called Marine Technology Advisors. MTA created a fairly dense survey and during the period when nearly 1,000 Panbo readers participated in it, we got to see who some our favorite sources are and what we were thinking about buying. Then, as MTA sliced and diced the complete data set, we got a peek at Panbo demographics on the site’s fifth birthday and what I thought was some very interesting analysis of brand recognition and perception. Meanwhile, MTA was at work behind the scenes trying to market their analysis to the trade, and I understand they got some good nibbles…

However, some personal and day job issues led MTA to go on hiatus for while. But now they’re back. In fact, MTA is now three men strong and will soon have a Web presence. And they’ll also soon be asking us to update last year’s survey and may have some new questions. Plus they’ve been looking over the original data set and have a few more results entries, starting with this look at annual spending patterns. Take it away, MTA:

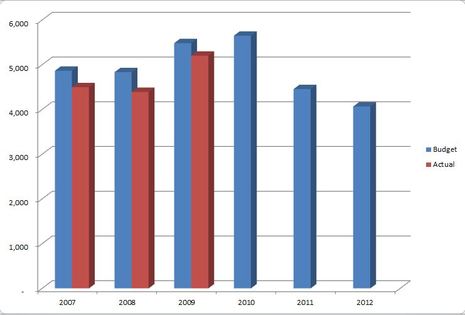

Was 2010 A Peak?

Average recreational marine electronics buyer budgets declined in 2007 and 2008. Budgets of ‘power users’ grew nearly 18% in 2009 and were expected to grow by another 3% in 2010. Changes in actual spending mirrored these trends generally. As budgets declined, so too did the share of budget that was actually spent – 92% and 90% in down budget years 2007 and 2008. However, 2009 was a turnaround year for the market, when budgets were forecast to grow nearly 13% and actual spending increased 18%. During that year, actual spend was nearly 96% of budget for the group surveyed.

The point here: When times are tough, as they were in 2008 and 2009, recreational boat buyers decrease their budgets, but decrease their actual spend even more. When times are good, they grow their budgets and spend materially, but, actual still trails budgeted.

Take Away: Mind the Gap

Marine electronics suppliers would do well to apply this insight to their forecasting models. Why? Because, if the trending is accurate, then 2011 budgets, which show a 21% decline versus 2010 – as of a year ago – may trigger a 25% decline in actual spending. Remember, in down budget years, the share of budget actually spent is closer to 90%, versus up years, when it is 95%.

MTA is looking to survey recreational users again this month to refresh 2010-2012 budgets, and capture 2010 actuals. This year, we will ask respondents for their actual Q1 spend to see if we can learn anything from that data. Perhaps the new data will show a more optimistic market? If not, perhaps this data will help suppliers and retailers adjust their spot material commit, promotion and advertising plans, and retool for a lower rate of spend in the forward 24 months.

For you buyer-readers: The market is yours again. Have fun pricing new toys.

Why (or pourquoi)? …is a huge question here. I’ve seen curves like this before. They can be driven by adverse economy, adverse legislation (eg, lux tax), demographic changes, etc.

They can also be driven by buyer response to seller behavior — deeply discounting electronics during a very weak market may have pulled future sales to the left and now leaves a valley of reduced demand/budget.

These curves can also be driven by the arrival of killer apps (In the 1998, Downes, Mui, Negreponte transactional sense of the word “killer”).

I suspect these data derive from a stew of effects. The question is how do I make my sales curve go up with market apparently moving down. In my prior life, that meant buying someone and moving their sales to my ledger. Good for my quarterlies, shareholder value might have taken a short term hit, and for the market, who knows?

The talk on our increasingly vacant docks (99% of whom never leave the Chesapeake) is, with smartphones, who needs marine electronics? [IMO, The USCG aggravates this locally by asking for cellphone numbers right after telling people to put on life jackets.] Obviously, this is not the market writ large, but for a purchasing assessment, Apps, may be this market’s killer app for a shrinking boating demographic that never leaves network coverage.

Wonder what the curves would look like if we included some fraction of smartphone and pad sales to replace explicitly marine electronics no longer budgeted for.

I have to agree Christopher, in the UK mobile networks are now so good that it’s possible to cross the Channel to France staying in touch all the way.

I’m sure the way forward is internet enabled comms and Nav, although the CG would probably disagree, Nav Programs like CE are leading the way on this front, and as soon as app platforms like Ipad and Android catch up, which wont be long, then it will all be do-able. I’m sure the first Android home PC cant be far away, if it’s not been done already. The trick will be converting all those PC programs to run on an ARM core, but I’m sure someone will invent an emulator at some point.

The other drawback is the internal antennas that the pad devices use which are by necessity broad band and by definition on some bands less than unity gain, but that is also being worked on.

This is a very interesting time to be in the marine game, as it often leads land based technologies by some margin, unless you have to re-invent a 30 year old technology and call it NMEA 2000 that is.

Steve

I don’t doubt that the rapidly soaring popularity of tablet computers is a significant factor here. Likewise for PC-based navigation systems, I think- there are now quite a few such programs that are quite capable, and are much less expensive than dedicated plotters/MFDs. The computer itself is a cheap commodity item these days at one-fifth to one-tenth the cost of an MFD.

Don’t forget “feature overload” and the rapid obsolescence that comes with rapid progress. When I look at product lineups from two years ago, then at today’s, I see huge progress in every respect and more features than I could possibly use. Boaters might be asking why they should upgrade now, when something even better and/or cheaper will be along in another year or two? Or when the cycle of obsolescence is now so short that the system will be hopelessly outdated by the time its warranty expires?

It’d also be interesting to see the breakdown of complete new systems versus add-ons to existing systems. Radar, for example, used to be a stand-alone purchase; now, adding radar often means adding a new MFD, which means new networking and possibly new sensors. Perhaps some boaters who would buy something as an add-on now say “well, if it’s gonna cost THAT much to integrate, maybe I’ll wait”.

A simpler explanation: Boaters polled in early 2010 foresaw declining electronics budgets because they’d at least like to think that once their systems were improved they’d last for a while.

It’s interesting you bring this up. My problem is I have experienced such high reliability and system life from my 2005 equipment, I cannot justify replacing perfectly good electronics even though the tech base marches on. And that march isn’t always favorable.

I just was informed by my cartography provider my 2011 Chart chip will cover less geography because layered data is eating up memory that had been available for “charts.” Since this is both a memory card capacity issue and a memory address issue, I may ultimately find myself having to replace perfectly good radar/chartplotter hardware ($4000) due to feature creep — what’s eating up the memory on the card cannot even be addressed by my radar/plotter firmware/software.

I’ve asked the provider to consider marketing chips that are optimized to (age) classes of systems — not just one-size-doesn’t fit-all. I doubt they will do it because hardware and software are like pairs skaters whipping each other across the ice, each intermittently depending on the other’s momentum.

This is very true Christopher, I gave up pursuing proprietory, MFD/on board-Navchip solutions way back after Garmin stopped G-Chart support for my old but very reliable Garmin 235 Plotter sounder. Monochrome only of course, but did the job as NMEA central. The same as the old Autohelm 6000 (black case) series gear I inherited on the boat, nothing wrong with the stuff at all, but it wouldnt talk to anything else, however replacing the RX10 CRT radar with an SL72 pathfinder, cured that problem as it had an inbuilt Seatalk to NMEA bridge. So I cant see anything wrong with old gear, if it works why replace it? The problems come with forced manufacturer obsolescence, which I’m sure they do just to sell new gear.

I will admit to having a 551s on board, because I do believe that you need one central reliable nav source, but other than that these days my Nav is all done on PC with either CE or MX 10.3 with black boxes of differing flavours, under constant modification and experimentation, some home built as well.

Hope to be getting a Xoom next week sometime, if I can can keep it secret from you know who??, so that opens up lot more experimental opportunities both comms and Nav.

Steve.

Steve,

The four horsemen of the information technology consumer apocalypse, harbingers of credit card fatigue:

Betas shipped as 1.0

Feature Creep

Vendor Lock-in

Moore’s Law

Chris