Kees at Mets, almost like walking the show

Wow, Kees Verrujit, our N2K Panbot in an attic, has out done his own reporting on last year’s METS, and he even shot some videos for us. A collective tip of the beanies to Kees, please:

In

general the feeling was quietly positive. Everyone still around will probably be able to weather the remainder of the economic storm. Attendance today was lower than the earlier two editions I visited, but then this was my first time visiting on the last day so I can’t say for

sure how busy it was. Sorry to say, there was no big big news. Still there were a number of exciting new developments. I’ve kept those to the end of this long mail!

There were two things that

stood out from the crowd for me. First of all there is a definite trend

towards using computer displays for ‘dedicated’ engine displays. With

that I mean that the suppliers of engine dials are all scrambling to

produce flexible displays that can show multiple pages of J1939 or

other engine data. The other one is lighting. There were NO lights to

be found other than LED. Last year you could see maybe 50% LED with

some leading companies going all the way, but now everyone has fully

switched over.

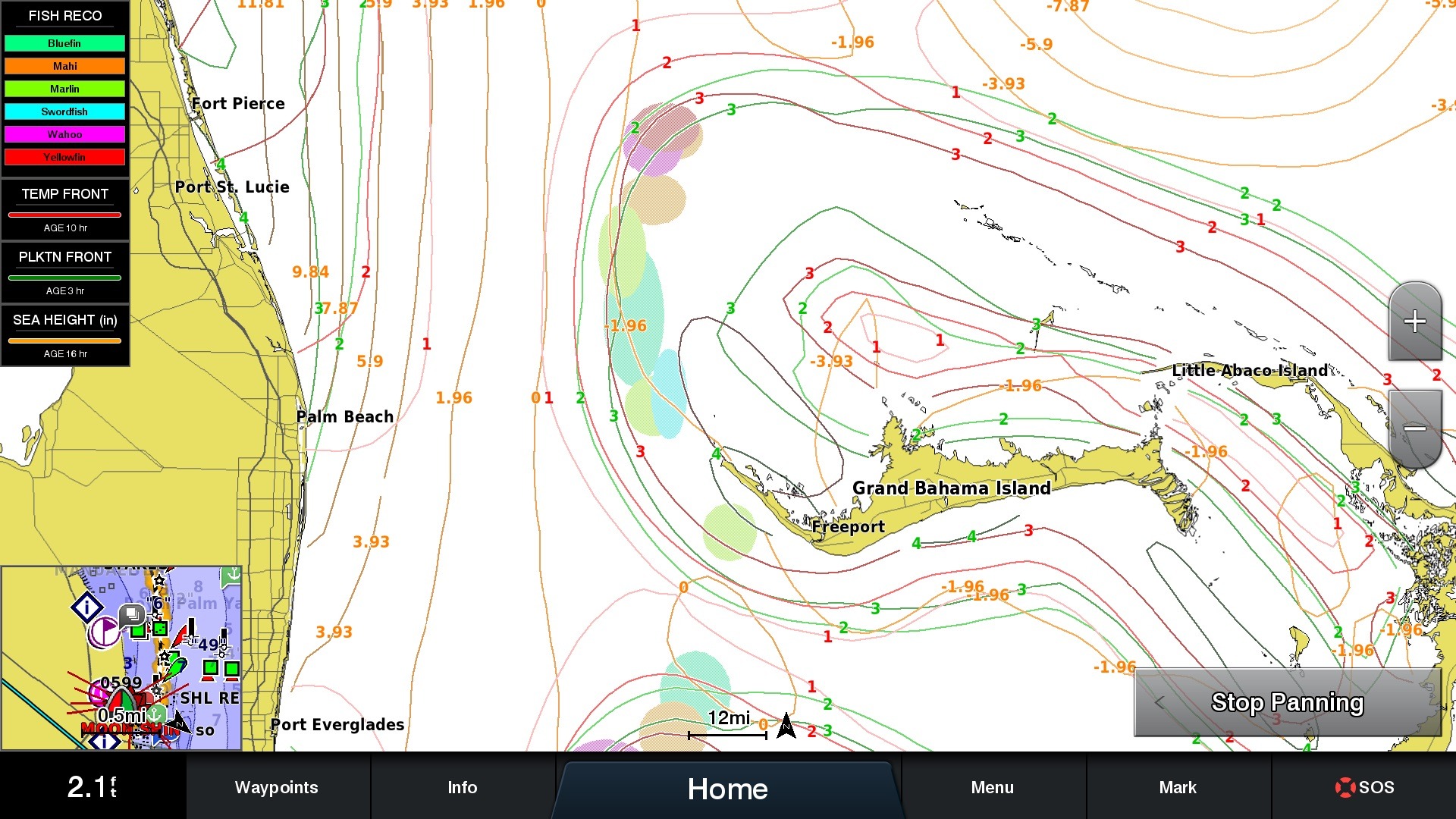

Weather

As I

suspected there was no news (or I missed it) on marine weather. As

there are no digital radio satellites over here (that’s done over

normal airwaves) there is no XM or Sirius weather in Europe, so nobody

that I saw focused on satellite weather. There were a number of

satellite TV dish suppliers though, including some new Asian companies.

It looks as if Intellian and KVH are going to have competition on their

hands.

MFD developments

I

did make a point of looking at all three new MFDs (at least for me):

the Raymarine E series Widescreen (with touch), the Simrad NSE 12 and

the Garmin GPSMAP 6000/7000 series (where the 7000 has touch as well).

My subjective impressions:

The touch screen worked but dragging charts was very clumsy and

non-intuitive as the display lagged 1 to 2 seconds behind my input.

That immediately destroys the illusion of actually dragging what you

see on the screen. Otherwise a decent plotter, but not a great step

from the C series Widescreen. {Editor: E Widescreen software is definitely Beta, but was looking good to me on Penobscot Bay today; more on that tomorrow.}

The way that detail builds up once you are at a new zoomlevel is one of

the best I have seen. It felt stable and solid in operation, even

though it did not have a touchscreen.

I was really impressed with how the automatic guided routing was able

to determine that the boat should use the “small boat” lock in

IJmuiden. Now this was explicitly running Beta software cut especially

for the show. This was noticable as I was able to lock up the 6000

quite easily (video here).

Also, booting it took 52 seconds. I’m sure that Garmin will fix this

before they go into production. When they do this they will have a

winner on their hands. Using it immediately made the older ones look

clumsy. Navnet 3D is slow compared to these babies. Pity they’re so

expensive.

using a number of Lowrance displays. The current marketing no longer

pushes lower radiation as the major point, it’s down to the fourth item

on the list. The claims made now are more realistic and state:

- Crystal clear image

- InstantOn (TM)

- Low power consumption

- Extremely low emissions

- Quick installation

- Automatic clarity

talk about. I have it from other sources that they are working on some

non-display stuff, but that’s apparently all still hush hush.

all, the DST 900 is in active development and they plan to release it

‘when it is done’. This hopefully means 2010, but they might encounter

a snag. That will follow a redesigned CS 4500 where they will split the

actual depth sensor from the electronics, which will be in a separate

black box. That black box will produce both NMEA 2000 and 0183, just

like the PB 200. There’s also a ST 800 coming, which will lose the

Depth but still be a “smart sensor” that produces NMEA 2000. The PB 200

will gain even more sensors such as relative humidity. After developing

the PB 100 they left that out of the PB 200 as the actual sensor would

corrode in the marine environment, but they plan to tackle that using

field replaceable humidity sensors.

certification for their NGT-1 and NGW-1 NMEA 2000 interfaces, but they

were able to enlighten me about what was actually certified. Although

Actisense can now claim that the NGT-1 is NMEA 2000 certified, other

vendors producing software that uses their NGT-1 cannot claim that

their software is NMEA-2000 certified — yet. For that they are

actively working with the NMEA and there will be a process where

vendors have their software tested by Actisense for a very low fee

after which the vendor can use the NMEA 2000 label.

engines, smart electrical buses etc. is improving but not yet really

fully on with all manufacturers. Empirbus was showing a new generation

of digital power switching system called NXT that is NMEA 2000 based (as well as Ethernet).

interesting new diesel generator combines three products in one: a

mains inverter, battery charger and diesel generator {photo below}. The diesel

generator can vary the revs (1200 to 3600) and its output. The output

is 400V which feeds to the inverter. The inverter can supply 3.5 kW

with an additional boost of 4 kW from the battery. Since the 230 or 110

V power is generated digitally the power is much cleaner than that

supplied by normal inverters. Since the inverter can borrow power from

the battery it can supply much higher startup loads and therefore the

size of the generator can be chosen to be just a little larger than the

normal working load instead of the peak load. Boat builders save on

installation as there is only one box to fit. Boat owners get lower

noise levels as the generator can run at different speeds, so it will

run at low speeds if possible. It will automatically shutdown if the

load is too low and use the batteries instead.

instance program it such that it either runs until the batteries are

100% and two hours after that, or until the batteries at 80% and start

when the batteries are at 20%, except between midnight and 08:00 AM.

- Why all in one? What happens if the generator fails?

- Don’t the electronics suffer from the heat produced by the engine?

the generator can produce voltages and frequencies that are unsuited to

be fed directly to devices. It’s the inverter that converts that into

clean mains power. This improves system efficiency and also allows the

generator to always run “loaded” so that it does not run at unnecessary

speeds. If the generator fails the battery charger and inverter still

function normally. The system has been engineered such that the

electronics are shielded from the heat of the engine.

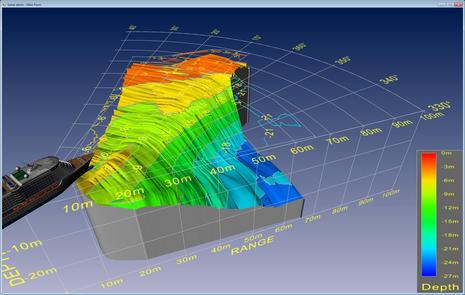

This uses their usual black box approach where you show the output over

video input to a MFD or computer display. Unlike their existing

products this uses two (multi-faceted) sensors that produce a real

“map” of the area ahead of the boat.

to appreciate this. Autonnic specializes in fluxgate sensors. Their new

A4036 Wind Sensor Module measures wind speed and direction by measuring

the force that the wind exerts on a small plastic ball that is linked

to a magnet moving near a fluxgate. This produces currents in the

fluxgate just like in a fluxgate compass. They do not plan to sell

directly to the public but intend to OEM the product.

Nice work, Kees; wonderful summary. Echopilot’s 3D sonar looks exceptionally sweet and seems a generation beyond FarSounder. Did they talk price at all?

BrAVO, Kees! Better than being there (considering the consequences of a 6 hr flight) and succinct!

What did the transducers for the Echo look like?

Thank you!

I’ve asked Echopilot to comment here as I don’t know about their prices and haven’t seen the actual transducers.

Hello,

The price should be about �5000 for the whole system (which excludes the display).

The transducers (it needs two, one on each side of the boat)protrude about 1.5″ from the hull and are just under 2.5″ in diameter.

Hope this answers your questions.

Chris from the EchoPilot team.

Very Well Done Kees !

youve got a heading there for NMEA 2000 sensors, not sure if you noticed on the garmin stand there were some cool analogue to NMEA converters for rudder angle sensors and trim etc.

Thanks, Kev! Garmin seems to be releasing that little product with zero fanfare. But apparently it’s going to ship soon, or already is:

https://buy.garmin.com/shop/shop.do?pID=35606&locale=en_EN#featureTab

What’s not clear to me is if it can just be calibrated for rudder sensors. I assume the calibration happens on a GMI10, though they could also include it in the MFDs.

The Autonnic vector wind sensor is a cool idea, nice and simple, at least without compensating for movement and accelerations.

I read on another forum about problems with Raymarine… Are they about to go belly up? Their stock is tanking.

Ben do you have any insider information?

No, I don’t, SanderO, and believe it would be a crime if I did. I continue to think that largely what we’re seeing is tough British stock market rules at work, plus the good old rumor mill. I’d be quite surprised if Raymarine products stopped being offered and serviced.

I will write more about this soon. Which forum were you reading?

As for Raymarine I’d say they’re just waiting to topple over! There’s no need to listen to the rumour mill. Just go straight to the London Stock Exchange and read Raymarine’s interim management report from last week:

Taken straight from statement:

Raymarine plc, a global leader in the supply of electronic products to the leisure marine market, today issues its second Interim Management Statement for 2009 as required by the UK Listing Authority’s Disclosure and Transparency Rules. This statement is in respect of the period 1 July 2009 to 18 November 2009.

There has been some reduction in the rate of sales decline on the prior year, with sales for the 4 months from 1 July 2009 to 30 October 2009 totalling �25.4m, a decline on a like for like basis, removing the incremental sales contribution from acquired distributors and foreign exchange movements, of 26.4% with the US and the Rest of the World showing like for like declines of 25.2% and 26.9% respectively.

For the 10 months to 30 October 2009 the Group’s sales totalled �88.9m (2008: �115.3m), an absolute decline of 22.9%. On a like for like basis this represented a decline of 32.3% on the prior year with the US down 46.2% and the Rest of World sales down by 24.3%.

By way of context, for the half year to 30 June 2009, the Group reported sales totalling �63.5m (2008: �83.6m). On a like for like basis this represented a decline of 34.6% with the US sales down by 53.0% and the Rest of World sales down by 23.3%.

The outlook for the Group’s markets continues to be uncertain and is expected to remain so throughout the remainder of the current year and during 2010.

Raymarine continues to invest in new products and launched its ST70 range of instruments and pilot systems and AIS 500 Plus in July and is launching an all-new widescreen E Series with hybrid touch, at autumn shows in Europe and North America.

The Group has reached agreement with its manufacturing partner on pricing for the anticipated volumes going forward. However, gross margin continues to be under pressure from market conditions and inventory provisioning.

The Group has incurred during the second half of the year significant exceptional costs in relation to professional and bank fees considerably in excess of those envisaged at the half year stage. These have been caused by the continuing exploration of the long term refinancing options for the Group. At 30 October 2009 the Group’s net debt was �91.6m. The Group’s existing banking facilities mature on 31 March 2010. Raymarine is currently unable to comply with certain financial covenants within these facilities and, as such, is reliant on continuing covenant waivers from its banking syndicate. The current waivers expire on 4 December 2009.

To meet the Group’s funding requirements in the coming months an additional facility has been agreed with the Group’s banking syndicate for �15m. This additional facility also matures on 31 March 2010 and its availability is similarly subject to the continued covenant waivers referred to above.

Long term refinancing options continue to be investigated, together with discussions with interested parties in relation to a potential sale of the business or equity fundraising. In light of these discussions the Board considers it increasingly likely that little, if any value for ordinary shareholders will be realised.

– ENDS –

Ben, more about Raymarine on the IBI website:

Quote:

Raymarine’s troubles continue

By IBI Magazine

Raymarine’s troubles don’t appear to be easing. In the wake of its latest trading statement, shares fell to an all-time low of 7.5p on Friday after the company admitted it was unable to meet its debt covenants.

Stockbroker Panmure Gordon also stopped research coverage of the stock. “Due to the company’s uncertain future and the failure of a trade buyer to emerge during the summer, we have decided to cease research coverage in this stock,” says Panmure.

Yesterday Raymarine told the market that it could not meet certain financial covenants and it reported a 23 per cent drop in sales in the first 10 months of 2009. Other brokers have Raymarine as a ‘sell’ stock. “There is unlikely to be much left in the way of value for shareholders, even if the company does get taken over,” says Seymour Pierce. Earlier this year Raymarine was talking with Garmin as a possible buyer but no deal came of it.

Raymarine developed a strong leadership in manufacturing and supplying navigation systems, which was fine while the market was strong. The downturn and the company’s heavy indebtedness of some �91.6m at the end of October have seen its fortunes reversed. It is now in desperate need of a buyer and without one it may well face collapse.

(20 November 2009)

John, hope you saw that I responded to your thoughts at the end of the new Raymarine entry:

https://panbo.com/archives/2009/11/raymarine_e-wide_hands-on_1_money_talk.html

For a more sailboat oriented view of METS including about two dozen video interviews, check out my report: http://forums.sailinganarchy.com/index.php?showtopic=98902

Not a lot of electronics, but the interview with Formula One’s Cosworth on their new data logging solutions is pretty cool.